Summary

The banks are the institutions which help in monetary policies of the country and also they help in saving the amount of people of the country. There are many types of banks who are running right now in the country for different purposes. People deposit their money into the bank for safety and predicated on this the bank provides interest on the amount they have deposited.

The customer retention is incrementing day by day and the bank consequently the daily transaction limit of each bank is also increasing which is adding extra burden on the employees for recording the transactions. Because of the high volume of transactions there may be chances of error increases.

Managing the maxima of each customer is a very consequential task it requires to be tally in all the records of the central database to track down each penny. Because recording of each transaction will provide transparent cognation between the customer and the bank. It avails in maintaining the goodwill of the bank and customer’s trust increases.

The banking management system avails in not only maintaining the database but additionally avails in engendering reports which will be subsidiary for other functions of the bank. There is so many other works which is done by the bank but now it requires to be automated to abate the mode of work on the employees.

Current System

In recent times, employees need to inscribe down each transaction and the books from different journals and then tally each other which will increase their work load because there are so many transactions which are transpired by the customer in a single day.

The system is very effective and requires more time of the employees to work on it but it will not give any kind of guarantee that the work will be done error free because of the human involvement. The work is done on the substructure of the many and consequently it requires more precision but it is lacking in the existing system.

The transactions are recorded in pen paper mode therefore it is very crucial to safeguard each paper or documents of the customer which contains error because of the physical work. There is no backup of the transactions which they have written down in the books of the bank.

Expected System

Banking management system which is proposed here is more secure and accurate which will record each and every transaction done by the customer in the bank in a transparent manner and also it safeguard the banking details and the personal information provided by the customer.

The proposed system is automated so that each employee can track any record of transaction done in past by the customer and it also require very less men power to do the required tracking of transactions.

The system provides safety to the data and the system is more reliable and accurate it doesn’t need to be trained to using the system because the user interface is very friendly any person can do it without any problem. The system is need of an hour for banking industry.

SOFTWARE REQUIREMENTS

HARDWARE REQUIREMENTS

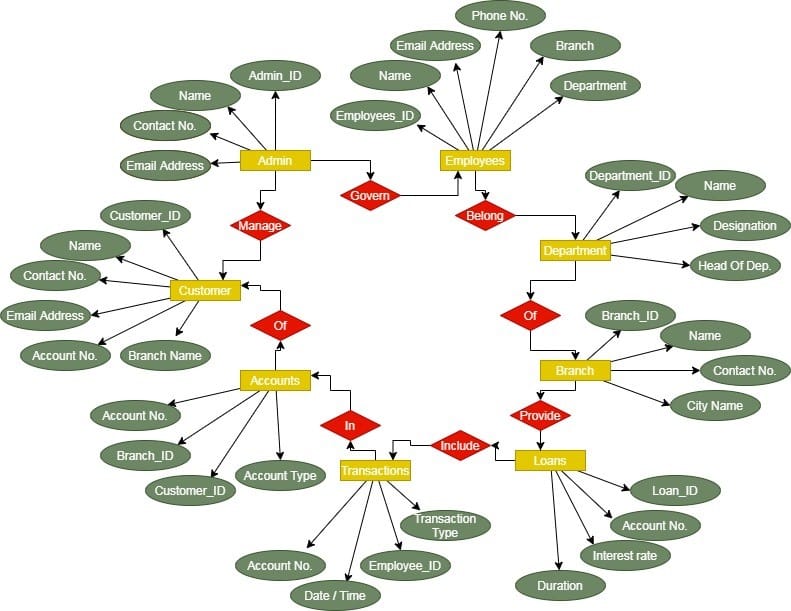

Entity Relationship Model

Elaboration:

The Model represents how the data should be maintained in the system which is governed by the admin because he is the controller of the system and provide the necessary input into the system and make it error free for fast controlling as in a bank the server should be up to date and it should run with the speed because there are many customers who do the transactions daily simultaneously which need to be stored in the database securely and accurately. The entities and their attributes are discussed below:

- Admin:

Admin controls the system and if any error occurs into the system then the admin rectified it completely. The admin is the head entity who controls the system and he can also access the accounts of employees as well as the customers to do the necessary changes and modify the return data and to the synchronize it with the central system database. The required attributes of the entity are discussed below:

- Admin_ID: Identity Number is given to each admin which is unique and generated by the system for authentication purposes.

- Name: Sometimes the management decides to authorize more than one person as an Admin to manage the system with accuracy.

- Contact No.: Admin can be contacted at any point of time if the user faces any problem in the system.

- Email Address: The official conversation with the admin is done through the email address therefore his address is return in this attribute.

- Employees:

The employees are the backbone of the company who controls the system and manage the customers on a daily basis. They attract each and every transaction done by the customer and solve the queries raised by them. This entity holds the different accounts of employees along with personal information provided by the employees like their salary structure and leave management. The related attributes are defined below:

- Employees_ID: There are many boys who work in an organization therefore the system generates a Unique Identity Number for each employee.

- Name: The name of every employee is saved in this attribute to manage the database of each employee.

- Contact No.: Employees can be connected by the upper level management customer care for the contact number should be saved in this attribute.

- Email Address: The official email address of each employee is needed to have a valid conversation the customer.

- Branch Name: Each employee based on their experience and exposure, is worked in a particular branch which saved here.

- Department: There are various departments based on the work they do which also bifurcates the work done by the employees.

- Department:

This entity holds the data of various departments which are interlinked in a particular Bank. Departments like transaction, loans, human resource, marketing etc are managed by the employees who are experienced in it. The departments need to transfer data and files to each other department therefore they are connected through a server internally. The attributes of this entity are discussed below:

- Department_ID: Identity Number is given by the system to each department based on their work and description.

- Name: The name of each department is needed to be saved in this attribute for verification purposes.

- Designation: The employees who are working in a particular department designations are saved in this attribute.

- Head of Dep. Every department is headed by a person who is the higher authority, his information is safe in this attribute.

4. Branch:

Bank institution has numerous branches in every city, state or in whole country. The bank has branches not only in urban areas but also in rural areas to get them to get the access of each person. Scenario even a villager has an account number in the bank and he also doing transactions daily. The branches are divided according to the work they do in which some are commercial as well as summer Central branches who controls The Other rural branches. The related attributes are discussed below:

- Branch_ID: The system provides an identity number to each branch according to the work and type of the nature particular branch posses.

- Name: The name of each branch which is also written on the official documents of the branch is saved in this attribute.

- Contact No.: The contact number of each branch need to be saved in this attribute for customer connection purpose.

- City Name: This attribute contains the name of the city in which the branch of a particular Bank is located.

5. Loans:

The main source of income of each bank through the loans they provide to each customer and the amount as an interest they get from the customer. Therefore the data needs to be managed in the system with accuracy. Various types of loans are offered by the banks depending upon the need of a customer on which the bank charges to interest at a fixed rate annually. The proposed attributes are defined below:

- Loan_ID: An Identity Number is attached with each loan transaction done by the customer and employees for referral.

- Account No.: The loans are given to the customers based on the account number which is saved in this attribute.

- Interest Rate: A particular amount of interest is charged on different loans which are saved in this attribute.

- Duration: the loan which is given to the customer is provided for a particular time period in which the customer has to repay the full amount.

- Transactions:

There are many customers who visit the banks daily due to various purposes and the transactions perform by them is saved in this system by the employees by generating the ticket for each customer because every transaction need to be saved to track down the money of the customer in their accounts. Fully fledged transaction details need to be managed in the central system for verification purpose by the higher authorities. The related attributes are defined below:

- Account No.: The transactions are done by the customer through their account number which is located in this attribute.

- Date / Time: The transaction is done daily by the customers therefore the date and time need to be saved in the attribute as per the transaction.

- Employee_ID: The employee ID is saved in this attribute that is authorized to take care of a particular transaction done by the customer.

- Transaction Type: The transaction is to be done by the customer for various purposes the details need to be saved here.

- Accounts:

Every customer opens an account in the bank through which they can do the transactions of submitting or Withdrawal of money. The account number is provided to each customer which is unique and a 14 digit total. The accounts are of different type like saving, current or in partnership. The information filled by the customer in the KYC form is tally by the bank employees into their account after synchronization. The following attributes are discussed below related to this entity:

- Account No.: A 14 digit unique account number is provided to each customer who is saved here in this attribute.

- Branch_ID: This attribute holds the data of the branch Identity Number in which the account created by the customer.

- Customer_ID: Every customer has provided an identity number which is saved in this attribute

- Account Type: The type of the account open by the customer as per his need is defined in this attribute.

- Customer:

The customers are those people who open their account in the bank and do the transactions daily in which there withdrawal for deposit money in their account. The banks provide safety to the customers money on which the charge a particular amount of interest for the service. The customer can view his account and do the necessary changes in his personal information and also he can view the amount he has deposited in his account. The related attributes are defined below:

- Customer_ID: An identity number is provided to each customer by the system which is unique in nature.

- Name: The name of each customer is saved in this attribute which is also verified by the documents provided by the customer.

- Contact No.: Contact number of each customer need to be saved in this attribute to connect them at the time of need to provide any kind of update by the bank.

- Email Address: The bank provides details about the customer account it on the registered email address therefore it needs to be saved in this attribute.

- Account No.: Attribute holds the account number of each customer depending upon the type of account to he has opened in the bank.

Branch Name: The customer as for his comfort open account in the branch nearest to his residence.

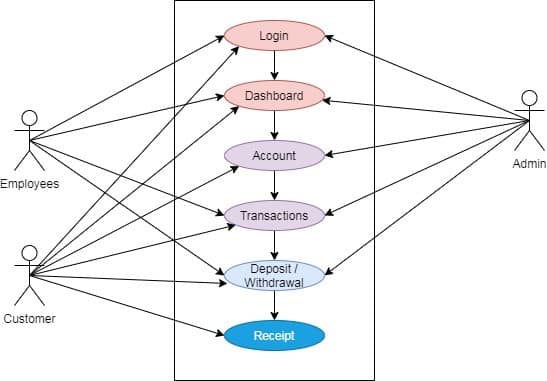

User Interface Diagram

Login:

The first interface which appears in front of every actor is the login page which provides necessary types according to the actor and based on that the other customizable options are provided to them for various factors. The other important aspect of this interface is that it can be customized as per the need of the customer and the employees along with updating the market policies in the system.

Dashboard:

After login the display which appears in front of the actors are the dashboard which provides steps as for the nature and authorization provided to each other. The admin gets full access to other actors accounts so that he can do the necessary changes in their accounts and maintain the diplomacy in the particular system apart from that other actors do not have access to view each other’s accounts.

Account:

The customer creates an account while visiting the branch of the bank but now due to the system he can also open his account through this portal after the verification will be done by the bank employees which are provided by the customer through the system. Therefore the interface provides document upload option in his display.

Transactions:

The customer do transactions as per his need and requirement also because of the type of work he do like business or profession which requires banking transactions every day. He can also get access through his interface from which he can view his account details like it deposit money and also we can apply for the loan from his portal.

Deposit / Withdrawal:

The transactions which is done by the customer is basically of two types which is the deposit or the withdrawal because the customer either deposit the money in his account for withdrawal the money from his account for different purposes or if we need to cash in hand.

Receipt:

After the deposit or withdrawal by the customer a receipt is generated by the employees to give them a proof of transaction which they have done. The system also provides an email alert through the system to the Employee’s account in which the details of the transaction is provided in the display of the customer.