Summary

People required loans for different purposes which needs astronomically immense amplitude of money in short period of time. People conventionally don’t have the amount of savings required for a particular work at that time they think about taking loan from any institute on a certain interest level.

It becomes facile for the customer to pay the amount bifurcated equivalently every month along with certain interest because people get their salary monthly therefore it is become feasible for them to pay the installment monthly of low amount. The loan will be sanctioned for a particular period of time for example 6 month, yearly and sometimes for more than a year.

There are many type of loans provided by the institutes like car loan, house loan, personal loan, business loan etc. Interest to be charged as per the type of the loan and the amount of loan to be taken by the customer. The interest rates are fine-tuned and transmutes after a certain period.

The institutes have daily transaction of loans taken by the customer therefore they need a system which helps them in managing the data and making their work smooth. The proposed system helps the staff members in managing the data and retrieving the information if needed in the future. The staff manages the accounts of the customer and helps them throughout the process of loan sanction. They can access the account of the customers if it is needed.

This system is additionally auxiliary for the customer as he can get the details of the loan along with the interest rate, the system also provides an estimated amount to be borne by the customer if he takes the loan. There are many times in life every customer needs loan because it is facile process and repayable without any encumbrance. The system also send alert to the customer if he has not paid the monthly installment of the loan.

The system saves the data of the daily transaction in a bank or Institute and save it permanently till the admin modifies the data. It helps the staff to retrieve the data of any particular customer if needed in any point of time and to see the history of any customer while providing the loan.

Current System

Staff member manages the data of the daily transaction of the customers done in a particular day in hard files and documents which is very hectic and time-consuming process. This system is very vulnerably susceptible because the documents can be modified or altered by any unauthorized person.

In the current system the process is very lengthy because the staff needs to check every single detail of the customer’s document and verify it thoroughly. It takes many days to process one loan after verifying the customer’s detail. The system is gradual and can hamper the crucial data of any customer.

If the staff members want to check the history of any customer then they need to go through store room and check from the file section which is handwritten and the staff member need to check every section of the compartment.

Expected System

The proposed system is very advanced and contains customizable tabs for every actor whether the admin, staff or the customer. The admin can access the accounts of every customer and do the obligatory changes if needed. This system is subsidiary for the staff members as they can see their salary bifurcation monthly.

The customer can edit his data in the system and also he can apply for any kind of loan through the system by giving input of his information. The system can estimate the amount of interest to be charged by the customer and it also shows on the interface of the customer the amount of installment he has to pays monthly.

The system is customizable as per the need of the institute and the volume of the institute. The process of the loan becomes fast due to this system and also it is transparent in every kind.

SOFTWARE REQUIREMENTS

HARDWARE REQUIREMENT

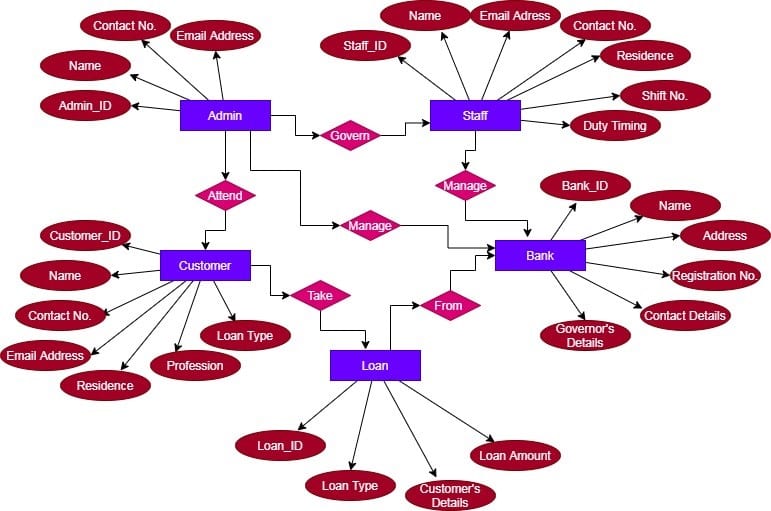

Entity Relationship Model

Expansion:

The model provides a diagram which declares the type of structure it follows to travel the data inside the system in a very fluctuation manner. The system provides data in a structured form so that the entities will be using the information as per their need and ranking. The entities are providing details by bifurcating the data in a title manner and help the users to get the desired data within time limit. There are many times when the information is to be used simultaneously by many entities then the system is capable enough to handle the work regularly. The entities and their attributes are discussed in detailed below:

- Admin:

The admin is the authorized person who takes care of the whole system and makes it error free. The entity holds the accounts of the admin and provides the authority to run the system and make changes in the accounts of other users. The admin power can be given to more than one person then also their individual accounts are created and secure in this entity. The related attributes are as follows:

- Admin_ID: The system attaches an identity number unique for every account to manage them and distinguish them from each other.

- Name: This attribute holds the name of the admin and make their system entitled on the basis of the name.

- Contact No.: The admin contact number is important to be in the system so that he can be contacted at the time of need or any other emergency.

- Email Address: The email address of the admin saved in this attribute is used at the time of need to send documents or attachments officially and have a record of it.

2. Customer:

The customers are the people who take the loan from the institutes and give interest instead. This entity holds the accounts of the customer and also takes care of the information feed in it. The customer can access their accounts through login credentials and make changes in their accounts but they cannot access other customer’s accounts. The admin can also access the accounts of every customer to analyze the data. The related attributes of this entity are:

- Customer_ID: The system generates new identity number for each customer which helps them in login into the system and unique for every single customer.

- Name: This attribute save the names of the customer, there are many customers and their accounts are bifurcated on the basis of their name.

- Contact No.: the customer phone number is also provided in the system to contact them if needed due to any transaction failure or other problem.

- Email address: The official conversation is to be done through their email with the customer and to provide legitimate solutions of every problem on mail.

- Residence: The verification of the customer is necessary to pass the loan therefore his residence address is saved in the database.

- Profession: Every customer’s profession is to be known as to sanction the level of loan amount to him after studying the capacity to bear the loan amount of the customer.

- Loan Type: According to the customer’s income and loan holding capacity, different loans can be applied by him who is saved in this attribute.

- Loan:

The system saves the data of the loans to be taken by different customers at any point of time. This entity provides loan type and the details of the customer who has taken the particular amount of loan. The Entity provides different account depending on the type of the customer and the type of the loan they have taken for a certain period of time. The customers can access their accounts but not other customers’ accounts and the loan accounts are sanctioned and managed by the staff. The related attributes of this entity are discussed below:

- Loan_ID: The system generates A Unique Identity Number to every type of loan which is taken by the customers and sanctioned by the staff and saved it in this attribute.

- Loan Type: This attribute contributes by saving the type of the loans taken by the customers as per their requirement and their capacity to repay it within time limit.

- Customer’s Details: The customer’s details are necessary to provide the loan and save the detail in the database of the system therefore this attribute is helpful in saving customers individual details.

- Loan Amount: This attribute contains the amount of the loan sanctioned by the customers on the basis of their monthly income.

4. Bank:

Banks are the institutes that provides loan to the customers on the basis of their capacity and the type of loan they need. This entity holds different type of accounts maintaining the information of the banks and its details. The entity bifurcates the different type of accounts and links them simultaneously with each other. It also holds the banks registration and address along with the governor’s details. The Entity details can be accessed by the admin and sometimes Limited access can be provided to the staff also. The related attributes are discussed below:

- Bank_ID: New type of Identity numbers are provided to the different type of banks whose data is incorporated in this system.

- Name: The name of the banks is to be saved in this attribute as the account of the banks are retrieved based on it.

- Registration No: Every bank is registered to the centralized bank that registration number is saved in this attribute for safety purposes.

- Address: The full location of the bank is saved in this attribute for official purposes and to provide documents and stamps based on it.

- Contact Details: The contact details of the bank are necessary to be saved in this attribute so that in case of need the bank can be contacted by anyone.

- Governor’s Details: The attribute save the data of the governor who takes charge of the bank as per their tenure in the bank.

5. Staff:

The staff members are the backbone of the company who provides necessary input in the company managing the data and solve the queries of the customer. This entity holds the accounts of the staff members bifurcating the information inside it so that the staff members can access their account individually and securely. It also holds the salary structure and the leave policy of the staff person along with his daily work report. The Entity holds some of the few attributes which are responsible to attend this which are as follows:

- Staff_ID: The system generates Unique Identity Number and tags it with the accounts of the staff persons individually to help them in accessing their accounts securely.

- Name: There is many staff members work in a company, there accounts are bifurcated as per their title taking their names as well.

- Contact No.: The staff members can be contacted at the time of need by the admin, customers, and any other staff member therefore the contact number is saved in this attribute.

- Email Address: Email address of every staff member is saved in this attribute conversation with them at the time of need can be partially done through it.

- Residence: The permanent address of each employee saved in this attribute to authenticate them through the process and to verify their personal details along with it.

- Shift No.: The employees worked in various shifts and every employee is assigned to a particular shift number which is rotational every week and save this attribute for clarity.

- Duty Timing: Apart from the shift, the timing of work every employee is different according to their designation in the task to be completed by them in a given time period.

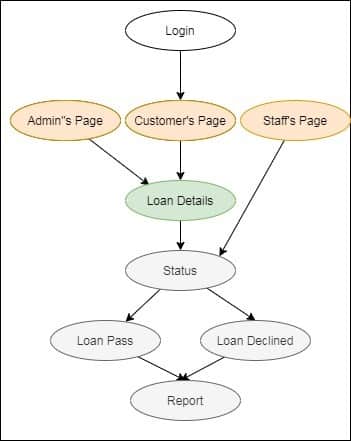

User Interface Model

Login:

The user interface provides the access to the users so that they can manage their accounts and do the necessary changes in the database according to the situation for the information provided. The login page is the first interface display on every users account which includes the login credential space and also some added special features like the forgot password and registration option for new users.

Admin’s Page:

The admin is the head entity who controls the accounts of every user in the database. His interface contains the access credentials to open any actors account in the system and do the necessary changes in the data of the account. Therefore, the admin’s page is secure and contains the maximum tabs which are customizable as per the need so that the admin can manage the system efficiently in make the system error free.

Customer’s Page:

The customers are the actors who can access their accounts and manipulate the data inserted but cannot access other actor’s data. The customer’s page includes the taps through which he can easily apply for the loan and get the details about it like this type of loan he can take and also he can add his income details so that the system can analyze the amount of loan which he can bear along with the interest to be paid on time.

Staff’s Page:

Staff members solve the queries of the customer and help them in granting the loan process smoothly. The interface provides the opportunity for the staff members so that they can see their leaves of the morning and the salary bifurcation and if there is any deduction it can be notified. They can also submit their daily report to the admin directly. They have limited access in the accounts of the customers they are serving currently.

Loan Details:

There is much type of loans provided by the banks as per the necessity of the customer for different purposes like personal and professional need. The database contains information of different type of loans along with the interest rate to be lent yearly on the customer. The system itself calculates the estimated interest to be given by the customer every month and shows it on the interface of the customer.

Status:

The loan process required various types of verification can be done by any bank it takes a few level of passing the file from the department to ensure the loan should be passed successfully. The system provides real time update to the customer by sending him alert through his contact number or Email therefore he can get the idea off the current status of his loan process.

Loan Pass:

After the verification process, the loan pass and the cycle of interest Start every month and reflect in the account of the customer. The system also send alert to the customer before the due date of the interest so that the installment should not be lapsed. The customer can pay the interest through the system by online mode.

Loan Declined:

There are certain possibilities that the loan may get declined due to any error in the document verification due to any other reason find out by the staff members in any level of the process. Sometimes the income of the customer is not up to the level to take the loan of the required amount therefore the loan gets declined and the message is delivered to the customer.

Report:

After the loan process done by the staff members daily for various customers, they send daily report to the admin briefing about the work they have done in a day they can also send weekly report including the status of the loans passed and declined tagging the details with it.