Now a day, people are dealing with much insecurity along with the management of their quotidian life. As the men are utilizing increasingly natural resources and due to major carbon emission, the pollution level has incremented drastically. Which in turn make humans sick and impuissant, there are several earnest diseases spreading daily and infecting humans ergo people are considering health indemnification to cover the amount if they fall sick and additionally to fortify their family at the time of financial crisis.

There are many types of insurances ranging from health, conveyance, fortuitous, death indemnification, etc. people enroll in the insurance as per their desideratum and the quantity of the indemnification to be submitted as premium on a fine-tuned time interval. The agent suggests the client about the types of insurances and convinces them to cover their indemnification which provides his commission from the company on a fine-tuned substratum.

The online insurance management system provides an online portal that is beneficial for the client, agents, and even for the company as well. This system maintains the data of the policy holder, agent information, premium details, and staff record as well.

The admin is the authoritative personnel who takes care of the full fledged system work condition and provide vital support throughout the process, he maintains the staff record and data of their circadian work, salary and leaves benefits, etc. the agent provides the details of the insurance policies to the customer and enrolls him for the policy as per his need apart from this he is also eligible so that the client pays the premium on time to perpetuate the policy schedule.

The characteristics are:

- It hampers the old paper system and provides a legitimate system that can carry the database without any error.

- The reports and the work done by the employees and the agent are transparent and the admin can control their accounts as well.

- The client can provide their personal details in the system which is secured and doesn’t show to anyone else.

- The premium due on the client is paid online by him in the system whose notification is sent to the client and agent as well by the system.

Current Scenario:

The current process is hectic and also there is no communication among the policy holder, agent, and the company. The clients have to visit the office of the agents and then the agent suggests the limited policies which he has as per the company he has tied up with. This forecast inhibited access for the client and he doesn’t visually examine the other available policies in the market. The agent also apostatizes the client sometimes to take a hefty premium from the client.

Check out our more articles below-

- Cattle Management System Project For Final Year

- Python or Java Which one is Best

- Complaint Management System for Final Year

- Hotel Management System MS Access Database Project

This mishap hardens the market of policy and ruptures the goodwill of the company. Therefore the system is necessary to centralize the information in a database that is capable enough for the smooth running of the process. In the current scenario, the process is done by extreme documentation because the policy enrollment to the client is done on papers and then it is submitted to the company, after a cooling period the company starts the policy of the client.

Even the client has to take care of the premium which is charged every regular interval. The agent needs to accumulate this payment and submit it to the company counter later. It is time taking process and sometimes the client forgot to pay the premium on time which engenders another mess for the client.

The core points of this system are:

- The procedure is elongated and requires physical hard work and time consummated to complete it.

- The whole procedure is recorded on papers that are vulnerable to keep it intact and find any document whenever needed.

- The client reaching is admired less because now only limited people and mouth publicity is considered here.

- There is no transparency in this system therefore the agent may charge an extra amount from the client on his own.

- Whenever a new policy comes into the market, it is not possible for every client to know about it at the same time.

Presenting System:

The proposed system is expeditious and secure, provides the utilizer an incipient interface for each actor whether the admin, client, agent or staff. The system provided tabs as per the sanctioned access of the actor. The client can enroll in the system from his habitation and get customary updates of the policies, he can even optate an agent predicated on the profile stored in the system.

The admin updates the system whenever an incipient policy is introduced by the company which is visible to clients additionally, they can get information of that policy. The system provides an extra hand to the admin, as he can accumulate the data of staff for salary preparation and leave management.

The agent can connect with the clients through the system and get commission online in his account directly. The client can submit the premium on time through the system by online mode. He also gets an alert at the time of the due premium date. This system is magnetizing more clients for the company and making the process smoother and paper-free.

The company doesn’t need to store the data on paper and keep them in files. It becomes more facile to run the system error-free, the admin can take care of the flow of data and provide bossism support. The staff manages the data of clients and agents and handles the queries of clients. The system generates a report for staff to submit it daily, weekly or monthly.

The salient features of this system are:

- The client can register in the system and gets an update about the policy from his home, he doesn’t need to visit the office of the agent.

- The client can directly contact the agent if he wants to enroll a particular policy or need extra information about it.

- The system is error-free and if any error occurs then it will be troubleshot by the admin in no time.

- The agent can get more clients through the system because more clients can reach the system and know about the policy.

- The agent doesn’t need to visit the client’s home to make him understand the policy he can now connect him through the system.

.

SOFTWARE REQUIREMENTS:

| Category | Minimum | Maximum |

| OPERATING SYSTEM: | Windows 7 is used as it is stable and supports more features and is more user friendly | Windows 10 and above |

| ENVIRONMENT: | Visual Studio .NET 2003 | 2019 version 12.7 |

| .NET FRAMEWORK: | Version 1.0 | Version 4.5.2 |

| LANGUAGE: | HTML – for coding. CSS – for webpage development. JAVA script – for styling work. | Net brans IDE 7.0.2 or Eclipse Neon. |

| BACKEND: | MYSQL SERVER 2000 |

HARDWARE REQUIREMENT:

| Category | Minimum | Maximum | |

| Windows | MAC OS X | ||

| PROCESSOR: | Intel P-III system | Intel Core i5 and above ( Intel Core i7) OR AMD FX 4100 and above, or A6 and above | |

| HARD DISK: | 40GB | 128 Gigabytes (GB)* | 128GB+Solid State Disk(SSD) with at least 20 GB of free disk space |

| RAM: | 1GB | 8GB | |

| PROCESSOR SPEED: | 833MHz

| ||

| Wired Networking: | Ethernet LAN Port or USB | Ethernet LAN Port or USB Ethernet Adapter/Dongle | |

| Intra server | |||

| Wireless Networking | 802.09g | 802.13ax | |

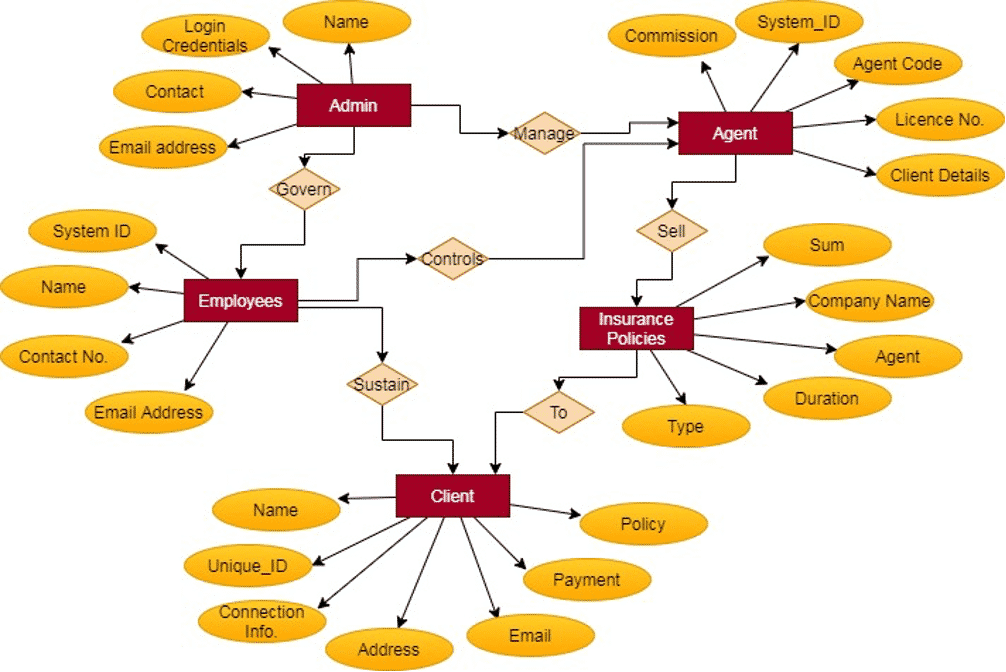

Entity Relationship Model:

Exposure:

The diagram represents the relation of the entities which are priory eligible for the sustaining of the system of policy which is to be done online. It provides a database which is containing all the entities and attributes to forward the details in the system at the time of need by the authorization of the admin. The related entities are explained below:

- Admin:

The admin controls the system of insurance agency management where he overthrows the data to be present in the entity wherever needed by other entities. He manages the system and provides troubleshoot at the time of emergency. It also updates the information in other users’ accounts. The related attributes of this entity are:

- Login Credentials: The system provides unique login credentials to each admin user to access their account safely.

- Name: This attribute manages the names of every admin who access the system as admin management.

- Contact Number: The admin can be contacted at the time of emergency or at the time of any error occur in the system.

- Email Address: The email address of the admin is saved in this attribute to communicate with him whenever needed.

The admin further deals with the agents who work for the company and gets commission in return. They have separate accounts in the system through which they can update their work and client information daily.

- Agent:

The agent entity holds the data of every agent who is connected with the company and provides a client to the company. They can access their account and update the client-related data along with their personal files and documents in the system. The attributes of this entity are:

- System_ID: The system provides a unique identity number to each agent to secure their account login.

- Agent Code: The Company has given a code to each agent who is working for the company to distinct their identity.

- License No.: Every agent got a license to do insurance agent work which is written in this attribute.

- Client Details: The agent connects with clients and suggests them different policies therefore this attribute holds the details of customers who are attracted by the particular agent.

- Commission: The Company gives commission to each agent as per the number of clients he retains for the company and according to the policy type.

The agent entity then holds on to the insurance policy entity which retains the information of the different type of policies taken by the clients as per their need and premium they can borrow each time.

- Insurance Policies:

There are many types of insurance policies that are processed by the company and the client choose it as per his need and also his monthly income to pay the premium amount properly therefore this entity holds the details of different policies viz. vehicle insurance, health insurance, etc. the attributes of this entity are:

- Type: This attribute saves the different type of policies which are sustained by the company.

- Duration: The policy bear by the client has come with a particular tenure which is written in this attribute.

- Agent: The policies are suggested by the agents therefore the particular policy has attached with the agent who suggested the client bear it out.

- Company Name: The insurance provided may be of different companies which are added in this attribute.

- Sum: Every policy is conjugated with the premium amount which is needed to be attached with the same database in this attribute.

The insurance policies are assembled for different tenure and amount, which is convincing for the client as he can enroll the policy according to his financial income and his need of an hour. The insurance a client takes for his health, vehicle, and for many other things.

- Client:

There are many clients attached with the company as they have taken various types of policy as per their need, this entity holds the data of the client’s personal as well as the policy-related details which are operated by the admin. They just need to create an account in the system for the first time. The attributes of this entity are:

- Name: There are many clients who have taken the policy simultaneously, this attribute saves the names of the clients.

- Unique_ID: While registering into the account, the system automatically creates an ID of the client which he can use for logging is saved in this attribute.

- Connection Info.: It saves the phone number of the clients to contact them whenever needed.

- Address: To send the file or documentation through post or to authenticate the client, his address is saved in this attribute.

- Email: The official conversation is done by email therefore the email address of the client is saved here.

- Payment: The client enrolls the policy as per his need which premium is born by him at a particular time interval.

- Policy: This attribute holds the data of the policies which are taken by the client and are under process.

The admin governs the system and takes care of the flow of data into the entities wherever required it also possess troubleshoot and manage the data of the employees and staff in the system, holding their daily work routine and salary structure.

- Employees:

The daily work routine of the company and the queries of the client and agents take care of by the employees of the company, this entity holds the data of the employees, their personal files, and daily report of the work they have done. It required the following attributes:

- System_ID: The system created a unique identity number for employees so that they can access their accounts securely by using these credentials.

- Name: This attribute holds the name of every employee who has an account in the system.

- Email: The email address of every employee is needed for communication in an official way with the client and the admin.

- Contact Info.: To connect with the employees at any time, this attribute holds their contact number to be used at the time of requirement.

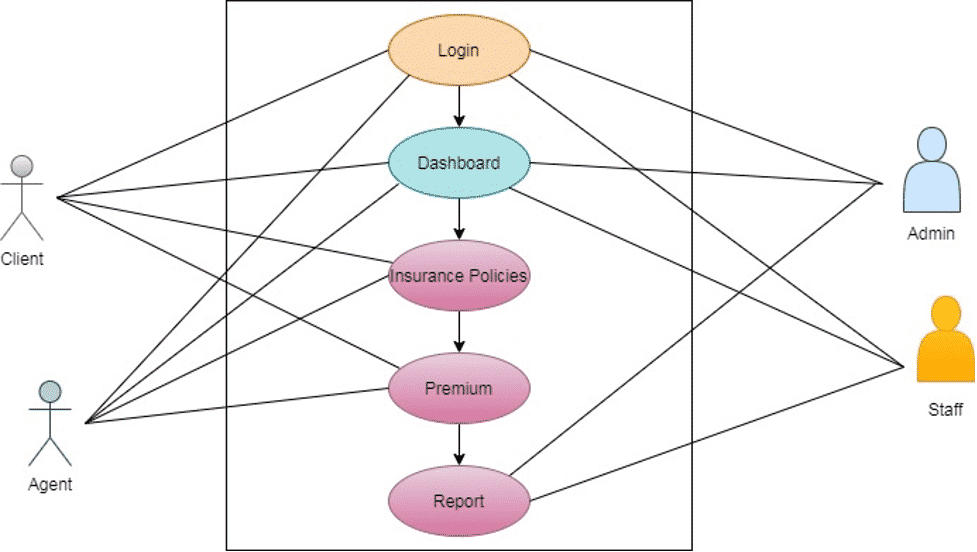

User Interface Diagram:

The system is designed as per the need of the company and bifurcated the interface according to the actor who has logging in the system. The admin utilizes all the functions which are made available on the dashboard, whereas the other actors viz. client, agent, employees, get limited access into the system database.

Login:

This is the initial page that appears at the time of entering into the system and accessed by all the actors but there are some tabs that are customized for particular actors like the registration option for new user client and a different tab for the agent login.

Dashboard:

The dashboard interface is the main entry interface which is customized as per the actor authentication and authority provided by the system. The admin gets all access whereas the other actors get options for limited access. The client gets the option of payment as well whereas the agent can see the details of the client also.

Insurance Policies:

The types of insurance policies are shown in the account of client and agent only. The client pays the premium which is suggested by the agent through his account and also the agent gets his commission through the system.

Premium:

This is the bifurcated amount which is a kind of installment paid by the client regularly as per the instruction of the agent who helps the client in the process. The system gives alerts to the client by mail and also sends this information to the particular agent to aware them.

Report:

The staff does the work daily and submits a report of daily work to the admin in the evening, it contains all the finalized work done by the staff throughout the day along with new queries and submissions of the clients and agents.